GST on rent RCM easy guide – The article will elaborate on applicability of GST on commercial & residential property, Rate of tax on rental income, place of supply , Time of Supply, Applicability of Reverse Charge Mechanism, availability of Input Tax Credit on GST Paid on rental income by registered persons and all latest amendment in respect of GST on rent.

The article is based on professional opinion of consultants at TaxLedgerAdvisor. Do not miss the professional opinion conclusion at the end of article.

Applicability of GST on rent RCM on commercial & residential property

Before 18 July, 2022, GST was applicable when property was being used for commercial purposes. Type of property whether commercial or residential did not matter in checking the applicability of GST on rent. The exemption of “Services by way of renting of residential dwelling for use as residence” was given vide Notification No. 12/2017- Central Tax (Rate).

Link to notification >> https://cbic-gst.gov.in/pdf/central-tax-rate/Notification12-CGST.pdf

On 18 July, 2022, Notification No. 05/2022-CentralTax (Rate) was released effective from said date, in which a additional entry was added in applicability of Reverse Charge Mechanism (GST has to be paid on reverse charge basis by the recipient of the such services). The entry is “Service by way of renting of residential dwelling by any person to a registered person“

Link to notification >> https://cbic-gst.gov.in/pdf/central-tax-rate/05_2022-ctr-eng.pdf

To Summarize the above 2 notification, A LAYMAN INTERPRETATION OF THE 2 NOTIFICATION COMES AS THAT renting of residential dwelling to registered person becomes taxable ( whether usage is commercial or residential) with effect from 18 July, 2022 and GST is payable on reverse charge basis. Further if tenant is registered person no matter whether owner is registered person or not GST will be charged by recipient of service that is tenant on reverse charge basis.

FOR PROFESSIONAL INTERPRETATION OF THE 2 NOTIFICATION REFER BELOW.

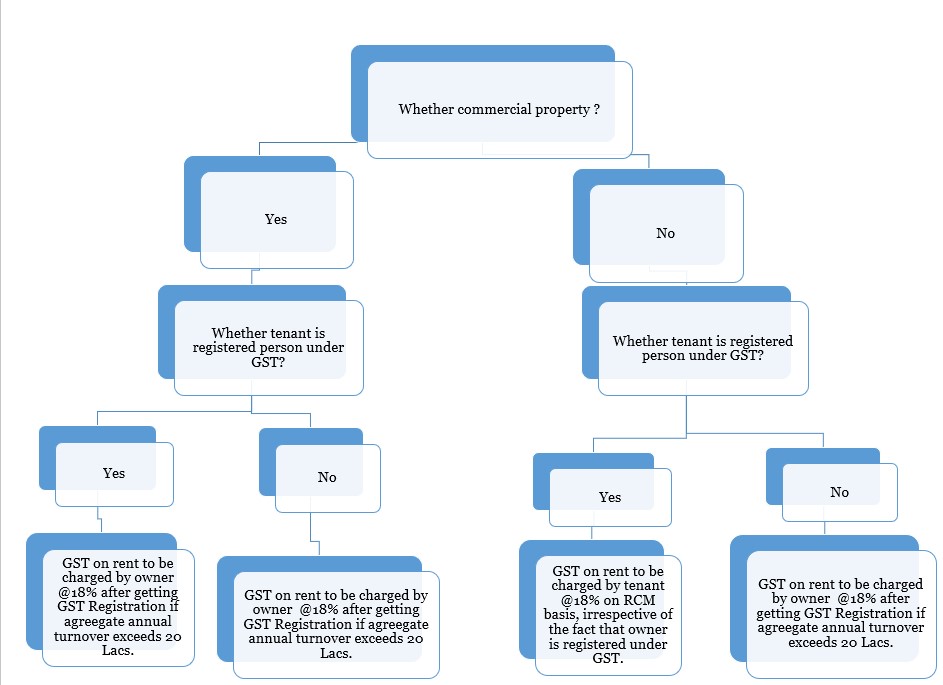

This flow chart below will quickly help readers to identify the applicability of GST on rent RCM :

Applicable Rates on GST on rent RCM

| Chapter/Heading | Description of Services | SGST | CGST |

|---|---|---|---|

| Heading 9973 | Leasing or rental services, without operator, | 9% | 9% |

Place of Supply on GST on rent RCM

Place of supply of services i.e. GST on rent is “Location of the immovable property” as per Chapter VI, Section 12(3) of the IGST Act. If Immovable property is located outside India, then Place of Supply will be “location of the recipient“.

The reference from the Act is as follows :

“Place of supply of services –

- directly in relation to an immovable property, including services provided by architects, interior decorators, surveyors, engineers and other related experts or estate agents, any service provided by way of grant of rights to use immovable property or for carrying out or co-ordination of construction work; or

- by way of lodging accommodation by a hotel, inn, guest house, home stay, club or campsite, by whatever name called, and including a house boat or any other vessel; or

- by way of accommodation in any immovable property for organizing any marriage or reception or matters related thereto, official, social, cultural, religious or business function including services provided in relation to such function at such property; or

- any services ancillary to the services referred to in clauses (a), (b) and (c)

shall be the location at which the immovable property or boat or vessel, as the case may be, is located or intended to be located. Provided that if the location of the immovable property or boat or vessel is located or intended to be located outside India, the place of supply shall be the location of the recipient.

(Where the immovable property or boat or vessel is located in more than one State or Union territory, the supply of services shall be treated as made in each of the respective States or Union territories, in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed.)“

Time of Supply in case of GST on rent RCM

Time of Supply in case of GST on rent will be in most cases date of payment to owner/landlord.

The reference from the Act is as follows :

“In case of supply of services, time of supply is earliest of –

- Date of payment as per books of account or date of debit in bank account, whichever is earlier; or

- The date immediately following sixty days from the date of issue of invoice or similar other document.

*Where it is not possible to determine time of supply using above methods, time of supply would be date of entry in the books of account of the recipient.”

Applicability of GST on rent RCM

Renting of residential dwelling to registered person becomes taxable with effect from 18 July, 2022 and GST is payable on reverse charge basis. Further if tenant is registered person no matter whether owner is registered person or not GST will be charged by recipient of service that is tenant on reverse charge basis. Also refer professional opinion in the last.

Refer flow chart above to identify the applicability of GST and RCM.

Compliances in respect of GST on rent RCM

- A person who is required to pay tax under Reverse Charge Mechanism has to compulsorily obtain GST Registered irrespective of the threshold limit of 20 Lacs/10 Lacs.

- Supplier of the services/goods cannot claim Input Tax Credit in respect of GST paid on RCM basis by recipient.

- Liability to pay tax on reverse charge basis has to be paid by cash ledger. No ITC can be utilized to pay liability of GST under RCM basis.

- Invoice level information in respect of all supplies attracting reverse charge, rate wise, are to be furnished separately in the table 4B of GSTR-1.

- Advance paid for reverse charge supplies is also leviable to GST. The person making advance payment has to pay tax on reverse charge basis.

- ITC will be available to recipient only in case where eligible and credit is not block credit.

- Every tax invoice has to mention whether the tax in respect of supply in the invoice is payable on reverse charge. Similarly, this also needs to be mentioned in receipt voucher as well as refund voucher, if tax is payable on reverse charge.

- Every registered person is required to keep and maintain records of all supplies attracting payment of tax on reverse charge.

Availability of Input Tax Credit paid on GST on rent RCM

ITC will be available to recipient only in case where eligible and credit is not block credit.

Few examples where ITC Paid on GST on rent RCM is available or not available :

- GST Paid by recipient in case of rent paid for residential purposes, ITC not available as this is block credit. As per GST Act “goods or services or both used for personal consumption” is block credit.

- GST Paid by recipient in case rent paid for commercial purpose, ITC is available as used in course or furtherance of business.

TDS on GST on rent RCM

TDS u/s 194I is required to be deducted in case of rent of Land, Building or Furniture if rent amount exceeds INR 2,40,000/- per annum and TDS Rate is 10% OR TDS u/s 194IB is required to be deducted if other rent exceeds INR 50,000/- per month and TDS rate is 10%. The TDS is required to be deducted on rent exclusive of GST.

For Example :-

Rent – 80,000

GST @18% – 14,400

TDS @10% – 8,000 (i.e. rent value excluding GST)

Need Expert Assistance on GST on rent RCM taxability, credit, registration

For expert assistance GST on rent RCM taxability, credit, registration in Udaipur and Rajasthan, reach our professionals at Tax Ledger Advisor.

Also refer other articles for us >> https://www.taxledgeradvisor.com/gst-registration/ https://www.taxledgeradvisor.com/gst-return-filing/ https://www.taxledgeradvisor.com/gst-return-filing/

Professional Opinion & Conclusion on GST on rent RCM

In our professional opinion, In case of residential dwelling being used for commercial purposes by registered person is taxable on forward charge and not on RCM basis and also if property is commercial property the taxes to be paid by owner on forward charge basis if rent & other supply exceeds 20 lakhs.

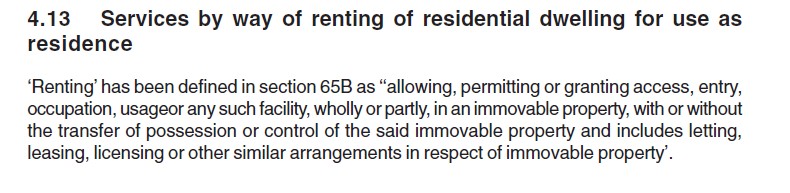

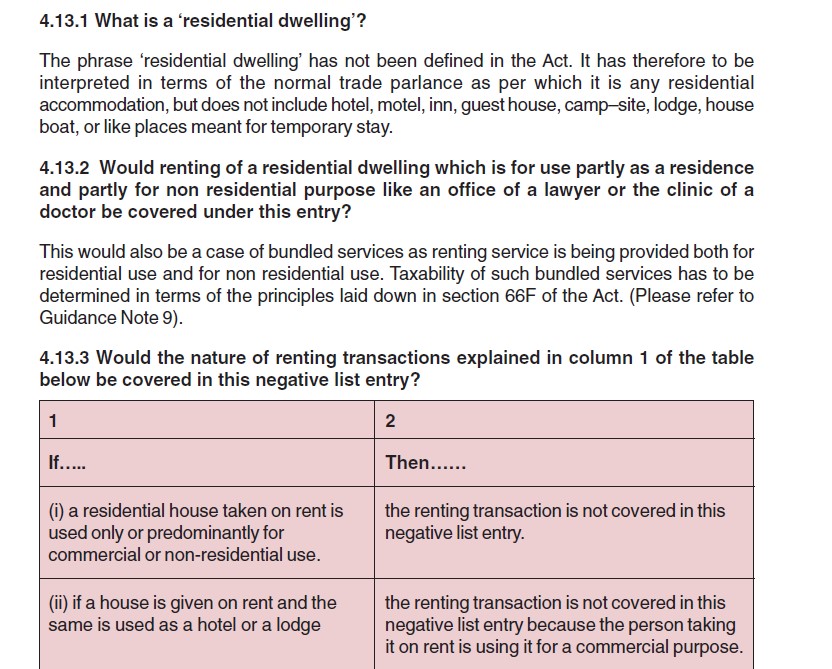

To conclude residential dwelling means any residential accommodation, but does not include hotel, motel, inn, guest house, camp–site, lodge, house boat, or like places meant for temporary stay.

The interpretation is also backed by education guide released by Central Board of Excise & Customs on June 20, 2012 with respect to this same entry in Negative List of Service Tax. Refer extract of the image :-

Earlier in Service Tax, the residential house taken on rent for commercial purpose was kept out of purview of negative list entry “Services by way of renting of residential dwelling for use as residence” and Service tax was chargeable. It is safe to interpret that WHEN USAGE OF RESIDENTIAL DWELLING IS COMMERCIAL, GST WILL BE CHARGEABLE ON FORWARD CHARGE AND NO CHANGE IN THIS CASE BECAUSE OF NOTIFICATION.

The contradicting opinion can be taken in this case where property is commercial or residential will be seen on basis of Land Revenue Act. If residential property is taken on rent for commercial use by registered person same becomes taxable on RCM basis.

The opinion is green is safe to assume at this point of time until and unless a further clarification/notification is released by CBIC.

Also opinion in red will create genuine hardships for registered person in cases where person is registered under composition scheme or where outward supply is zero rated or where majority of supply is exempt. GST paid on rent on RCM basis will have to paid in cash every month/quarter and input will be given but same will remain unutilized because of above cases and will block funds of registered businesses.

Critical examples on GST on rent RCM

- A office space in a residential dwelling and if tenant is registered person – GST ON RENT RCM NOT APPLICABLE. GST TO BE PAID ON FORWARD CHARGE BY OWNER

- Residential building of flat wherein a flat is lettable for office space and if tenant is registered person – GST ON RENT RCM NOT APPLICABLE. GST TO BE PAID ON FORWARD CHARGE BY OWNER

- A shop on ground floor and house on above floor and tenant is registered person – GST ON RENT RCM NOT APPLICABLE. GST TO BE PAID ON FORWARD CHARGE BY OWNER

- Company obtaining on rent – residential dwelling for residential use to facilitate its officers/employees/directors/guest – GST to be paid on RCM firm.

- Partnership obtaining on rent a residential dwelling for residential use to facilitate its partners – GST to be paid on rent on RCM by partnership firm.

THANK YOU!!! DO DROP COMMENTS FOR ADDITIONAL QUERIES.

1 Comment